Things about Paul B Insurance Local Medicare Agent Huntington

The Of Paul B Insurance Medicare Agent Huntington

Table of ContentsSome Known Incorrect Statements About Paul B Insurance Medicare Health Advantage Huntington Our Paul B Insurance Medicare Advantage Plans Huntington StatementsPaul B Insurance Local Medicare Agent Huntington - QuestionsThe Greatest Guide To Paul B Insurance Medicare Supplement Agent HuntingtonThe Main Principles Of Paul B Insurance Medicare Agent Huntington

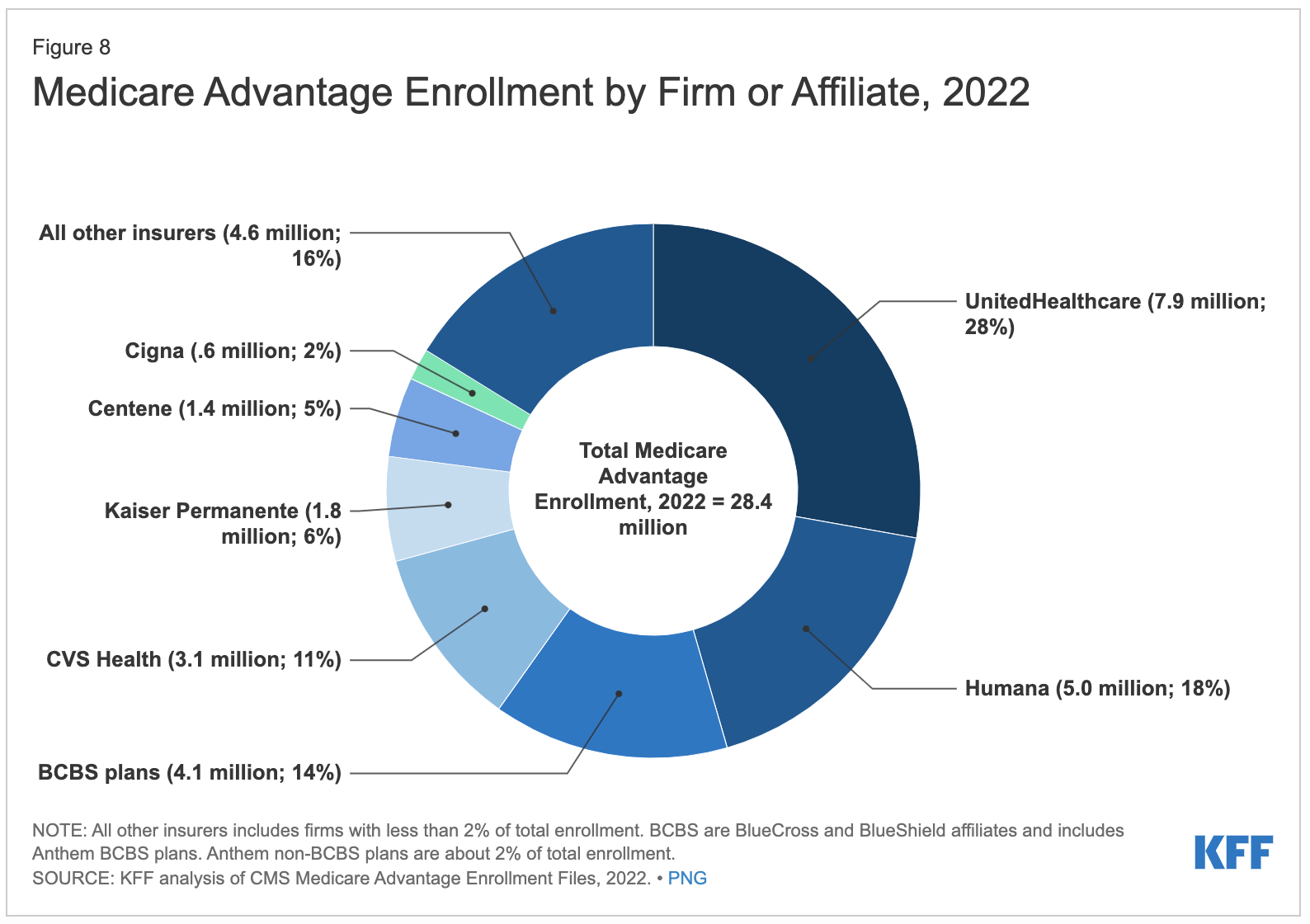

When you make use of the Medicare Select network health centers and also companies, Medicare pays its share of authorized fees and the insurance provider is accountable for all extra benefits in the Medicare Select plan. As a whole, Medicare Select policies are not required to pay any kind of advantages if you do not utilize a network supplier for non-emergency services.Currently no insurers are supplying Medicare Select insurance in New York State. Medicare Benefit Plans are authorized and also regulated by the federal government's Centers for Medicare and Medicaid Solutions (CMS).

What are the advantages and also restrictions of Medicare Benefit strategies? Medicare Advantage broadens wellness treatment choices for Medicare recipients. These choices were created with the Well balanced Spending Plan Act of 1997 to minimize the growth in Medicare costs, make the Medicare trust fund last longer, and provide recipients extra choices.

The Best Strategy To Use For Paul B Insurance Medicare Advantage Plans Huntington

Original Medicare will certainly constantly be readily available. This is a handled care plan with a network of carriers that contract with an insurance policy business.

This is similar to the Medicare Advantage HMO, other than you can use service providers outside of the network. This is an additional managed treatment plan.

This is an insurance plan, not a handled care plan (paul b insurance medicare advantage plans huntington). The plan, not Medicare, establishes the cost schedule for service providers, yet providers can bill up to 15% more. You see any type of companies you pick, as long as the supplier concurs to accept the settlement timetable. Clinical necessity is identified by the strategy.

The 10-Minute Rule for Paul B Insurance Medicare Part D Huntington

This is one of the handled treatment strategy kinds (HMO, HMO w/pos, PPO, PSO) which ho6 insurance is developed by a religious or fraternal company. These plans may restrict enrollment to members of their company. This is a medical insurance policy with a high insurance deductible ($3,000) incorporated with an interest-bearing account ($2,000).

Medical professionals must be allowed to notify you of all treatment options. The strategy needs to have a grievance and charm procedure. If a layperson would certainly believe that a symptom might be an emergency situation, then the plan needs to pay for the first aid. The plan can not charge even more than a $50 copayment for visits to the emergency clinic.

All plans have a contract with the Centers for Medicare and Medicaid Provider (Medicare). The plan has to register anybody in the service location that has Component An as well as Part B, other than for end-stage renal illness clients.

The Facts About Paul B Insurance Medicare Agency Huntington Uncovered

You pay any type of strategy costs, deductibles, or copayments. All plans may provide added benefits or services not covered by Medicare. There is normally much less documents for you. The Centers for Medicare and Medicaid Provider (Medicare) pays the plan a usaa auto insurance collection quantity for each and every month that a recipient is signed up. The Centers for Medicare and also Medicaid Services checks appeals and advertising strategies.

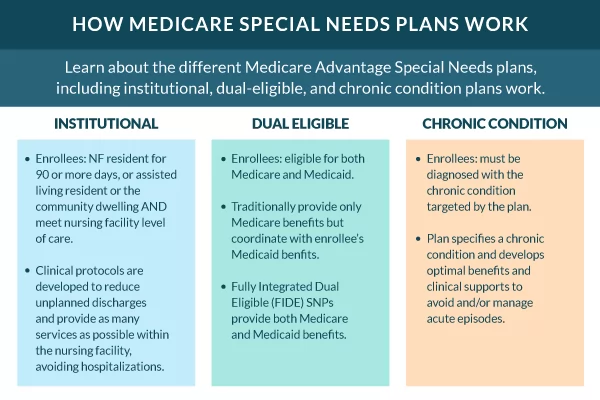

If you meet the following requirements, the Medicare Benefit strategy must enlist you. You might be under 65 as well as you can not be refuted insurance coverage due to pre-existing conditions. You have Medicare Part An and Component B.You pay i thought about this the Medicare Component B costs. You live in an area serviced by the plan.

You are not obtaining Medicare due to end-stage kidney illness. You have Medicare Part An and Part B, or only Component B.You pay the Medicare Part B costs.

Medicare Benefit plans need to supply all Medicare covered services and are authorized by Medicare. Medicare Advantage plans may provide some services that Medicare doesn't typically cover, such as regular physicals and foot treatment, oral treatment, eye exams, prescriptions, listening to help, as well as other preventive solutions. Medicare HMOs may provide some services that Medicare doesn't usually cover, such as regular physicals and foot care, oral treatment, eye tests, prescriptions, listening to help, as well as other preventative solutions.

Paul B Insurance Medicare Advantage Plans Huntington Can Be Fun For Everyone

You do not require a Medicare supplement plan. You have no expenses or claim types to complete. Declaring as well as arranging of claims is done by the Medicare Advantage plan. You have 24-hour accessibility to solutions, consisting of emergency situation or urgent treatment with providers beyond the network. This includes foreign traveling not covered by Medicare.